7 Steps to Making Your Blog a Business

You have been blogging for a while, your followers are growing respectably and you’ve monetized your blog or have decided to monetize your blog. You’ve opted to take the blog to the next level and become a business. But waaiiitt, how exactly do you do that? You’ve learned all about getting followers, promoting on social media, SEO optimization but what exactly does it entail to be a business? Don’t fret, this is MY area of expertise and I’m here to share with you 7 steps to making your blog a business.

This is a 2 part post. The first post (this post) will cover the steps to making your blog a business: Business structure, naming your business, obtaining a tax id #, licenses, and business basics such as opening a bank account, bookkeeping, and filing taxes. The 2nd post is a Q & A answering readers’ questions about the business of blogging. And at the end to those who opt-in, I’ll send a free “7 Steps to Making Your Blog a Business” FREE download.

Business Structure

Table of Contents

The very first decision you need to make is under what business structure you’ll operate this business. If you’re a one person US blogger your choices will be: Sole Proprietorship, Limited Liability Corporation (LLC), or Corporation.

Sole Proprietorship: This is the easiest form of business to organize. If you’re using your own name, you may find that you are done and that no legal registration is necessary.

Pros: Simple and inexpensive to organize, no separate federal income tax return required

Cons: Owner is personally liable for business debts and legal actions.

Limited Liability Corporation (LLC): A LLC is often a good business choice, being simple to organize but offering liability protection to the owner(s), and flexible taxation choices.

Pros: Limited liability to owners, choice of taxation (a single member LLC can be taxed as a disregarded entity or can elect to be taxed as an S corporation), less paperwork obligation than a corporation

Cons: May require annual state franchise fees (in California this is a $800 annual fee) and annual tax filings, cost to organize.

Corporation: A corporation is it’s own separate business entity, filing its own tax return and conducting business as its own legal entity.

Pros: Limited liability Protection for owners, easily transferable

Cons: Double taxation (profits taxed at corporate level, and then again when transferred to shareholder/employees), requires more paperwork than other entities, required to file annual tax returns. Overall more costly than an LLC or Sole Proprietorship.

I recommend that bloggers start off either as a sole proprietorship or an LLC. To organize an LLC you can use a service such as Corpnet which charges just $79 for their basic services, or visit your state’s Secretary of State website and do it on your own.

Naming Your Business

You can keep things simple and opt to just do business under your own name or more than likely you will want to choose a name that uniquely identifies your business.

One mistake I often see is too narrow a scope for a name. For example: If I’m starting a dog sitting business I might be tempted to call it Carolyn’s Dogsitting. Seems logical right? But what happens when I decide to take care of other pets? Carolyn’s Dogsitting wouldn’t attract cat or other pet owners to the business. A better name choice would be Petstays or perhaps name the business after a favorite pet.

While it may be desirable, your company name doesn’t need to be the same as your blog name. I have an LLC named Ruff Row Ranch LLC, underneath this LLC I operate various websites and blogs, including this one. If you opt for a name other than your blog name, I do recommend checking to see if the domain name is available for your business, with a domain name checker such as Namecheap Domain Search, and if the domain is available purchase it before someone else does.

Is your name available in your state? If you are using a name other than your own personal name for your business, you will need to register a DBA with the state and sometimes your county. What is a DBA? It means “Doing Business As” and is required when an entity operates a business using a fictitious name. To file for a DBA you can use a service like Corpnet or file directly with your state’s Secretary of State. Be sure to contact your county to see if they have any special requirements.

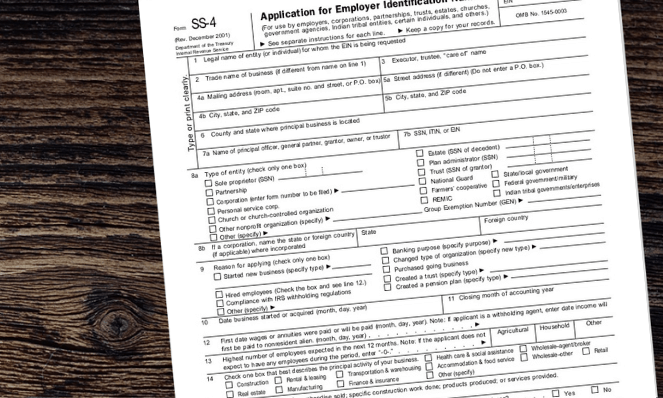

Applying for a Tax Identification Number

You’ll want to apply for a tax identification number regardless of operating structure chosen. Even a sole proprietorship should have one so that it may be used in lieu of your social security number.

You can apply for a Tax Id number (more commonly referred to as an EIN number) directly via the IRS website: Apply for an EIN number. You will receive your EIN immediately after successful submission of your application. The EIN number will be the number you use when asked to complete forms W-9 for affiliate programs and other vendors, and will also be used when opening your bank account and filing income taxes.

Sales Taxes and other Business Licenses

Your best bet to determine what business licenses you need to do business is to visit your state’s department of taxation website. Most states have a new business section that goes through all of the requirements to operate different businesses within that state.

If you’re selling products in multiple states you will need to determine if you have “nexus” within those states and if you determine you do have nexus you’ll need to apply for a sales tax permit in those states too. Determining nexus is complicated and is something you should discuss with your financial professional.

Open a Bank Account

Your business should have its own business bank account in its name. To open a business bank account (commonly referred to as a commercial account) you’ll most likely be asked for your EIN #, DBA, and if an LLC or corporation, a copy of your organization agreement or articles of incorporation, and sometimes a banking resolution. A google search should yield you a sample banking resolution for your entity type.

Choose a bank that has a good online platform since as an online business you’ll most likely be dealing with online vendors and customers. Avoid accounts with monthly fees, most banks will waive fees if you keep a set minimum monthly balance. It’s well worthwhile to transfer some personal funds to the bank account to meet this minimum. If you compute your fee savings you’ll see it equates to a great interest rate.

Don’t be lazy and skip this step, thinking you can just use your personal account. It’s important to segregate your business funds from personal funds and I assure you it will make your life easier doing the next step, bookkeeping for your business.

Bookkeeping for your Business

As a CPA, I full-heartedly recommend that you use a small business accounting program like Quickbooks (either online or desktop version) , or Zohobooks (online only) as your bookkeeping software for your business. Spreadsheets are soon outgrown and are prone to error. These programs are designed to meet the day to day needs of a small business and with their ability to import banking and credit card transactions will have your books up to date in a few simple clicks.

Quickbooks is probably the most popular small business bookkeeping software. If you plan on delegating your bookkeeping to a third party this is a good choice. It has online and desktop versions. I recommend not using Quickbooks Self-employed as it is very limited and doesn’t convert well should you grow out of it. The Quickbooks online subscription price starts at $25.00 a month (after the 3 month trial period expires) and the desktop version costs $199.00 a year.

Zohobooks is a great tool for small business bookkeeping and is priced right, FREE for businesses with revenues less than 50K! I am a fan of Zoho software and can recommend using this software for bookkeeping.

Filing Taxes and Tax Compliance

You will need to file your income taxes annually for your business regardless if it operates at a profit or loss. What form you’ll file depends on the business entity via which your business operates. A good accountant is worth their weight in gold (shameless plug for my profession) when it comes to preparing income taxes. Yes, there are many tax software programs out there that you can use to prepare your returns but sit back and ask yourself a few questions first: Are you a financial professional? Do you have an education in income tax preparation? Do you spend hours each year keeping abreast of tax law changes? If you can’t answer yes to all of these questions, you’ll be doing yourself a favor by seeking the assistance of a tax professional for filing your income taxes.

A good accountant can also be expected to inform you of any other compliance filings you’ll need to complete such as

forms 1099-nec to subcontractors, 1099-misc to lessors and other entities, payroll forms if you have employees, sales and revenue reports, and state annual reports or franchise returns.

And There You Have It: Seven Steps to Making Your Blog a Business

There’s a lot to digest here. And to make this easy for you to follow step by step, I’ve created a “7 Steps to Making Your Blog a Business Checklist” FREE download. It summarizes the steps discussed here and also includes a summary of the questions and answers featured in the 2nd post. Request your copy by subscribing below and it will arrive in your inbox shortly.

Have Questions about making your blog a business? Please read Part 2 of the post “Readers questions about Making Your Blog a Business-Answered.”

The form you have selected does not exist.

27 Comments

Abhi

It is such a detailed, well-written post that will surely help all the new bloggers like me. You cleared so my doubts I had in my mind! Thank you so much!

Carolyn

I’m glad it was helpful!

Lauren Klein

This is awesome! I just became an LLC and was looking for a free system for finances. I’ll be looking into zoho for sure!

Carolyn

Awesome, I’m so happy when readers find my blog useful! That is the whole goal!

Suhina

This was really insightful and helpful as a newbie blogger! Glad I found this post, thank you!

Carolyn

Im glad it is helpful!

Katherine

Very helpful to someone new like me. Thank you.

Carolyn

I’m so glad you liked this post. More like it to come!

Nadia

This is PERFECT! I started the process earlier this year but was so confused that I just gave up. This article definitely gives me motivation and direction on which way to go! Hopefully, I can get it all done before the new year.

Carolyn

Blogging IS overwhelming at the beginning, step by step you’ll get the pieces in place.

Tash

This is great! Such helpful tips for new bloggers, saved for future reference 🙂

Alexis

This is a great article filled with valuable information. I will be referring to it in the future when my time comes.

Carolyn

Great Ill be posting more like it. Stay tuned.

Chelsea

Wow this is great. Thanks! Question: I have been operating a SP since 2008 under my name for my freelance editing and writing business. I started a blog though (MamaHasHerMindful.com) and I’m not sure if I need to get a separate business license or DBA for it? 🤔 Or, if all payments are made out to my name, is that not necessary? TIA! Great info here!

Carolyn

What state do you do business in? In most states you don’t need a license to operate a SP and if MamaHasHerMindful.com is just the name of your blog and you don’t do business under that name then you wouldn’t need a dba.

Adventure Awaits Us At Home

I am new to blogging so this is very helpful. I have saved it so that I can refer back to it often.

Carolyn

Glad to be of help, there is so much to learn when you start out blogging, food luck with your blog!

Fd Shakil

This post was a great read. Full of helpful tips, I enjoyed and will implement several of these ideas.

Whitney Stewart

After I had started my blog and seeing how others have turned into a source of income, I’ve kind of been interested in doing the same thing. But it’s still up in the air at this point if I’m actually going to do it. Thanks so sharing though! I like how detailed you were in this post!

Rena

Hi Carolyn,

your posts and your life are inspiring, but I’m glad you also put down the actual nitty gritty of the business side of it – who wants to think about taxes, right?

Carolyn

Thanks, I try to help people take care of the nitty gritty so they can get on with living.

Alice Makena

I have been blogging for quite some years and I desperately needed this information. Thank you for sharing!

Carolyn

Awesome, always glad to help!

Veronika

Glad I stumbled upon your article. Most articles with a similar title focus on revenue streams and not HOW to set up a business. Thank you for the detailed information!

Carolyn

Perfect! Don’t you just hate it when google refuses to provide you with what you’re searching for?

N P

Thank you so much for the detailed information. I will definitely be saving this for later. Would you reccomend taking all of these steps even before your blog generates income?

Carolyn

If you haven’t monetized your blog yet, you don’t need to. But if you want to deduct any of the costs of getting it up and going as start-up expenses in the future it’s a good idea to start implementing everything from the get go.