How to Stop Being Broke: Change Your Money Mindset

Photo by Emil Kalibradov on Unsplash)This post includes affiliate links which means I may receive compensation if you make a purchase via one of the links (at no extra cost to you). Please refer to my privacy policy for more information.

How to Stop Being Broke?

Table of Contents

Are you tired of living paycheck to paycheck, and having nothing to show for it? You have a good-paying job but still, it’s a financial squeeze to get through the month and make ends meet. You want to stop being broke but don’t know where to start. More than likely. it’s your money mindset that’s keeping you broke. Before you can change your money mindset you need to know what exactly it is.

What is Money Mindset?

Let’s start with what money mindset is not. For many people who hear the phrase “money mindset” an image of a person like Charles Dickens “Ebenezer Scrooge” counting his coins pops into their head, a person obsessed with money. This is not what money mindset is.

Money mindset is your personal relationship with money; how you feel about it, your beliefs about money, and its role in the world.

Your money mindset is somewhat akin to the law of attraction, how you feel and relate to money will dictate whether you have no money, just enough money, or an abundance of money. Being an extreme left-brain type I’d love to say the path to financial success is to simply work hard and spend less, but sadly this is not the truth, money mindset comes into play and it’s amazing how much it controls the outcome.

Different types of Money Mindsets

I’m sure you’ve noticed that some people are inherently spenders while others are savers. These spending habits aren’t related to having an abundance of money or lack thereof, they are a reflection of that person’s individual money mindset.

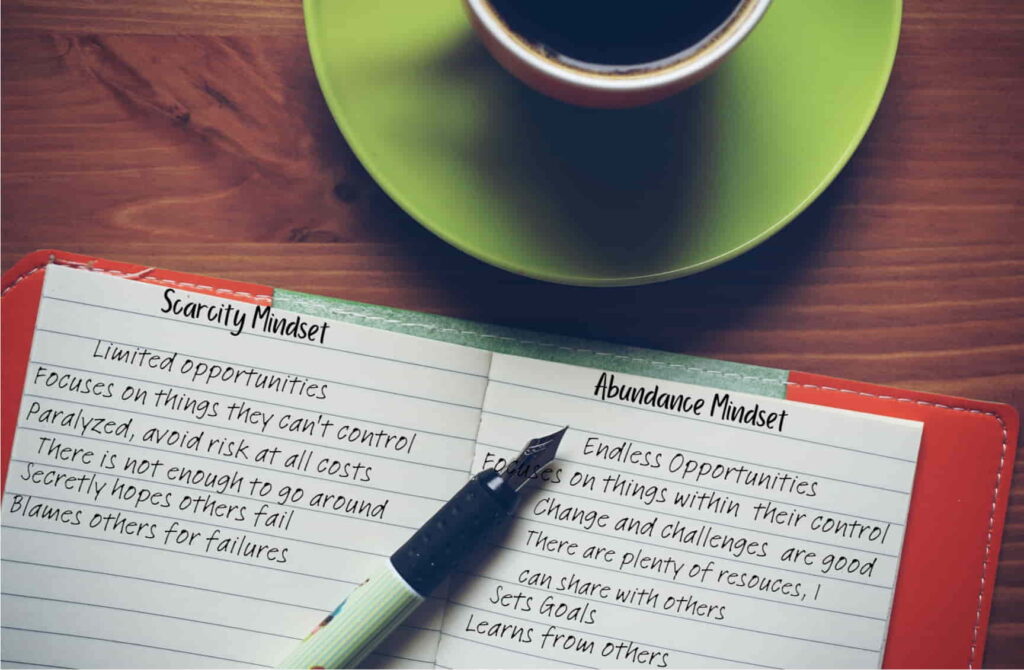

There are basically two basic types of money mindsets: scarcity mindsets and abundance mindsets. These can be further broken down into different sub-types. Do you identify with any of the following scarcity mindsets? Don’t worry, identifying the problem is the first step in your journey to stop being broke.

Scarcity Mindsets

Scarcity mindsets are based on the belief that there are limited resources in the world, and if someone takes more, you’ll get less. This mindset cultivates fear, jealousy, and selfishness.

I Have Enough Mindset

This is the mindset; “I’m comfortable with what I have. I can pay my bills, I have a roof over my head, why do I need more?”

This kind of mindset is dangerous, it’s a mindset of avoidance. You will never have more than enough and the loss of a job, or a sudden emergency expense, can push you over the edge where you don’t have enough.

Money more than likely causes you stress after all you believe, “ money is the root of all evil”.

Money Grows on Trees Mindset

My husband used to justify additional expenses by saying “I’ll just shoe another horse” (he was a horseshoer). The problem is did he really just shoe another horse? No, he didn’t actively go out and look for another horse to shoe. If not reined in, he had a habit of spending every dollar twice.

This is the “money grows on trees” mindset, I can always earn another dollar so it’s OK to spend it today. It can also be considered a debt mindset or a spenders mindset. You try to buy happiness, and instead, end up with debt and stress.

This mindset will most likely get you into a lot of financial trouble.

“Never spend your money before you have it.” –Thomas Jefferson

Extreme Frugalist or Under-Spending

Frugalists are always penny-pinching. They will always pick up a penny on the sidewalk, and they don’t enjoy shopping as it means spending money.

Frugalists can account for every cent. I can attest to this as I’m a frugalist.

When checking out with my groceries I can usually tell when something’s been rung up wrong. I don’t consciously tally the total as I go but sure enough, when the cashier tells me the total, I’ll know if it is right or wrong. 95% of the time I’m right.

Being frugal in and of itself is not a bad thing but it can go too far. It can drive you to unhealthy conservative behavior and make you limit your risks and therefore limit your ability to maximize opportunities. It can make you deprive yourself of things that you value therefore depriving you of happiness. It may lead you to refrain from making preventative maintenance expenditures that will cost you more in the long run or opting to buy cheap over quality and to go without when you shouldn’t.

Abundance Mindset

An abundance mindset is based on the premise that there are enough resources and success in the world to share with others. The world is filled with opportunities and possibilities. Those with an abundance mindset can separate themselves from the notion that more money equates to more happiness, and prioritize time over money.

“Do you know 79% of Americans believe more money will bring more happiness?”

I find that mind-boggling.

In a “Happiness” study by the University of British Columbia, researchers observed the following:

“What we saw is that UBC students who in their year of graduation, prioritized time over money…ended up on a better path for happiness”.

Characteristics of an Abundance Mindset

People with Abundance Mindsets share common characteristics, some of which include:

- The belief that there are endless opportunities,

- Change and challenges are good, after all “nothing ventured, nothing gained”

- Take control rather than react

- There are plenty of resources, I can share with others

- Collaborates

- Inspired by others

- Focuses on the long term, sets goals

- Recognize that there is power within thoughts

What Does This Have to Do with Me Being Broke?

You might be wondering at this point, what all this has to do with you being broke.

If you have a scarcity money mindset money and wealth will evade you. If you have an abundance mindset, money and wealth will find you. You might be saying “Hogwash” and getting ready to click away but give me a minute.

There’s a 100% chance that if you’re focusing solely on what you don’t have, that you’ll fail to have more.

It’s that simple. Focusing on what you don’t have keeps you right where you’re at-broke. I read a good analogy this morning about inertia and money mindset. Inertia by definition is “a tendency to do nothing or to remain unchanged.” And inertia is often our default behavior. Doing nothing is not going to change anything.

Change the behavior and you’ll start to see some changes in your “brokeness”

How to Change Your Money Mindset

Where did your Money Mindset Come From?

Before you start to change your money mindset it’s wise to see where did your money mindset come from? Much of your money beliefs became part of your mindset by the time you were just 7 years old.

Think back to when you were growing up, was there a lot of stress about paying bills? Did a job loss send your family into poverty or result in a move to an impoverished neighborhood? Perhaps your family had money but your parents were always working and didn’t have time to spend with you or your siblings. Maybe there was something that you wanted to have so badly, but Mom yelled at you “we don’t have money for that kind of thing”. Or alternatively was your family trying to buy happiness, always going overboard at Christmas and sporting the latest best car in the driveway?

These negative experiences and others along the road to today formed your money mindset.

Ready to Change?

Let’s get down to business and get you on the path to success and an abundant mindset, by learning from others.

I recently read a post by a young lady who had just become married and was overwhelmed with all the expenses she was incurring at this particular juncture in life. She wrote the following:

“How do you get your finances organized after an anomalously expensive series of events (eg getting married). All of my recent spending data feels unreliable and now I’m in the habit of “ok I’ll just pay for it”

We can probably all relate in some manner to this statement, when we lose control and the bills just keep rolling in. We feel like we’re struggling to stay afloat, and just when we think we’ve managed to get a foothold, along comes another bill.

What should this young lady do?

The first thing she needs to do is initiate change. She needs to take control of this tidal wave of expenses and commit to becoming financially stable.

Steps to Initiate Change

The following steps to initiate change answer this particular young lady’s dilemma. Your steps may very well be similar or quite different, but these responses to her situation should help you to come up with your own steps for change:

- The first thing this young lady needs to do is adjust her mindset, look at her situation as a challenge, and take an “I’ve got this attitude”.

- Next, she needs to take control. What is the underlying problem with her finances? Why has her spending become frivolous? Does she lack goals? Setting some goals is a great way to motivate oneself to take control. She needs to hold herself accountable and track where her money is going.

- Once she knows where her money is going she needs to create a budget. A budget will rein in her spending while enabling her to save for her financial goals.

- The budget may reveal that she needs to change her spending habits, perhaps she’s spending too much on a daily coffee at Starbucks, or going out after work. She’ll next work on replacing those habits with less costly habits.

- She should review the outcome of her budgeting efforts monthly. And compare where she ended up versus where she had budgeted to be. It is VERY motivating to see the debt start to disappear and savings start adding up.

- Successful people tend to read books. Here are a few suggestions on some books that will help you find the path to financial success:

- Rich Dad Poor Dad, Robert Kiyosaki: The #1 personal finance book of all time, is about the difference in mindset between the poor, middle class and rich.

- The Millionaire Next Door by Stanley and Danko: Identifies common traits amongst millionairs in the USA

- Atomic Habits by James Clear: A comprehensive and practical guide on how to create good habits, break bad ones and become 1% better everyday.

- Your Money or Your Life by Vicki Robin: The purpose of this book is to transform your relationship with money.

Are you Going to Stop Being Broke

There you have it, how to stop being broke laid out clean and simple. Now all you have to do is take action, you have nothing to lose!

32 Comments

Fransic verso

The mindset is everything when it comes to success and changing our lives. These are great tips! Thank you for sharing!

Carolyn

If only more people realized this!

Valery

This is such a great post and I’ve learned so much! I definitely need to take some time to apply this advice to my own mindset around money! Thanks for sharing your thoughts.

Carolyn

Glad you liked it, I hope it helps you to become a person with an abundance mindset.

Heather | Globetrottingmoms.com

Thank you for sharing. I definitely need to change my mindset when it comes to spending! Whilst I’m sometimes frugal and sometimes I’m also a money grows on trees type! Penny wise, pound foolish as the expression goes! I feel I will get there, but yes – an abundance mindset needs to be worked on!

Carolyn

It really makes a difference and does budgeting and paying yourself first ie transferring money upon receipt into savings.

Tina Riegelnegg

Never though about what money mindset I have before but I think I’m the “I have enough mindset” 🫣

Carolyn

The I have enough mindset is easy to fall into but can deprive you of great things! For starters are your goals big enough?

Katherine McLee

Mindset is so important! I think most of us have had limiting beliefs when it comes to money in some way or another. Working on changing that mindset is where the big changes happen!

Carolyn

It’s incredible how much easier everything becomes with the right mindset!

Paris

I am actively working with a financial planner right now to help farther my financial literacy! You are so right about mindset!

Carolyn

Great to hear, it sounds like your financial planner is getting you on the right track!

Zandra I Castillo

I definitely believe in developing an abundance mindset. I was always broke in my early twenties because I had a scarcity mindset. I wish I knew this info when I was younger.

Carolyn

It is amazing what a difference it can make!

Giada

Great post!

I definitely see myself in the “frugal” mindset type of person…But it’s so true that change starts from within!

Carolyn

I think many of us who are money conscious find ourselves there. And there isn’t a problem with frugality…but one must remain conscious of balance.

Christine Mathews

Mindset is everything! And I believe it all starts with gratitude. Thank you so much for the great article.

Carolyn

You’re very welcome, gratitude is so important. Like they say ” what goes around, comes around”

Sheenia Denae | Lifestyle Blogger

Great read! Mindset is everything.

Carolyn

It really is…if only people more people would understand this.

Charlie

Awesome post! I definitely need to apply some of these tips to my life and mindset ☺️

Carolyn

Charlie-do it! You’ll see a return quickly!

Favour

Great post! I am finally leaning towards the abundance mindset! Perspective and mindset is everything.

Carolyn

So true! It’s amazing the power of positivity!

Sara Besic

Yes, I love this article and Rich Dad Poor Dad is one of my favorite books as is the Millionaire Next Door. Such great informationa nd resources within the article.

Carolyn

I’m glad you enjoyed it and also have read my book recommendation!

Teri DEMBETEMBE

i love this. i was just thinking about an abundance mindset, and trying to figure out my own path. Thanks for this

Carolyn

Teri that’s great! Mindset really does make a huge difference.

Fransic verso

These are great tips, definitely need to work on them and make sure we don’t be broke. Thank you for sharing!

GOERGE

Thank you for addressing the importance of continuous learning and self-improvement when it comes to making money. It’s a reminder that personal growth is intertwined with financial growth.

GOERGE

Your advice on part-time earning is invaluable.

Liana

thanks for info.