How to Keep Books for Your Small Business

Last Updated on February 12, 2025 by Carolyn

Congratulations on turning over a new leaf and starting your own small business, be it a blog, YouTube channel, or storefront venture. That first step of actually starting is the biggest one! Now, let’s unravel the mysteries of how to keep books for your small business.

Why Do You Need to Keep Books for Your Small Business?

Table of Contents

Keeping books for your small business is essential to being successful. Books are also required for compliance purposes such as taxes and rent calculations. And oftentimes attentiveness to your books will reveal fraud and mistakes.

Measuring success

Your business books can be a tool you can use to gauge what actions are successful, or not.

For example: You have a 2-for-1 sale on a product for a month. You know you sold a lot of that product that month but did the sale result in increased profits?

If you keep good books your answer will be revealed in the books.

Compliance

You need to keep track of income and expenses for sales and income tax purposes. An auditor will not accept a pile of receipts on his desk as support for claimed expenses.

Organized books will streamline any audit and reduce angst, and potential assessments.

Reveal Mistakes and Fraud

If you keep your books up to date, you have a much better chance of catching mistakes, price increases, or even fraud soon after they occur.

Mistakes

A few months ago I earned a commission. The company from whom I earned the commission requires the submission of an invoice for the commission so I submitted an invoice.

I was doing my books a couple of months later and saw they hadn’t paid my invoice yet and I brought it to their attention. As it turns out they needed something additional on the invoice but hadn’t let me know. I updated the invoice and received payment. If I hadn’t been reconciling my books I wouldn’t have caught this when I did and might never have been paid.

Fraud

Another area where keeping books pays off is finding fraud. I can’t tell you how many times I’ve found fraudulent charges on my credit cards. Although I try to review my credit card statements each month, sometimes time gets away or I simply miss things in my scan.

When I’m doing my bookkeeping I have to classify expenses by category and when I don’t recognize a charge I’ll google the company name to see what it might be for. Sometimes it’s a legitimate charge, and the name on the statement just differs from the DBA name but many times my Google search doesn’t ring any bells, and sure enough it’s a fraudulent charge. One month I found a $400 FedEx charge on my credit card statement that wasn’t mine!

Price Increases

It’s often when I’m doing books that I find price increases. I have some recurring expenses on autopay and though the company might send an email notification of a price increase these often go unread or Gmail puts them in a folder other than my inbox, and I don’t see them.

Here’s a recent example:

As a CPA I had a free payroll service. I wasn’t actively using it since I’m retired but I hadn’t cancelled it. Lo and behold my free service term expired. I found this the 2nd month after they started billing me $92 a month for the service. I canceled the service and was able to get refunded one month of service. I cringe to think had I not been diligent in updating my books what this might have cost me.

Can I Keep the Books Myself?

You can absolutely keep your small business books yourself and I highly recommend it with just a few caveats:

- You must have time. If you are already stretched thin this may be a good task to outsource.

- You don’t hate dealing with numbers and paperwork. If you hate dealing with paperwork you’re likely to procrastinate and let the papers pile up until it’s an enormous undertaking and then because it’s an enormous undertaking you may procrastinate even more.

- If your time is more valuable doing something else, it doesn’t make sense for you to the books unless you enjoy it

One reason I’m a great supporter of a business owner keeping the books for their small business is that you’ll see and touch everything. You’ll see when expenses are skyrocketing or when revenue is falling. When you write a check for the huge heating bill you may be more likely to turn down the thermostat.

Should I Hire A Bookkeeper

If your filing system looks like this…you might want to hire a bookkeeper!

If you don’t have time, hate numbers and paperwork, or your time is more valuable elsewhere by all means hire a bookkeeper. I always say “Do what you’re good at, and hire someone else to do the rest”. It’s good advice to follow as long as you can afford it.

It doesn’t make sense to outsource very minimal bookkeeping needs, by the time you’ve assembled the information for your bookkeeper and sent it to them you might very well have completed the books.

Where to Find a Good Bookkeeper

I always recommend getting referrals whenever possible. If you are entrusting your bank statements and credit card statements to your bookkeeper, you’d better be sure they are trustworthy.

Your accountant may be able to recommend someone, or perhaps your local chamber of commerce will have a recommendation

Review Their Work

Once you’ve hired a bookkeeper don’t go a whole year without looking at their work. You need to review it to make sure they understand your business and are doing a good job. I’ve come across many bookkeepers in my career who haven’t got a clue what they are doing.

If you don’t know enough to review their work, ask your accountant to take a look at what they’ve done for you and ask them if they have suggestions for improvement.

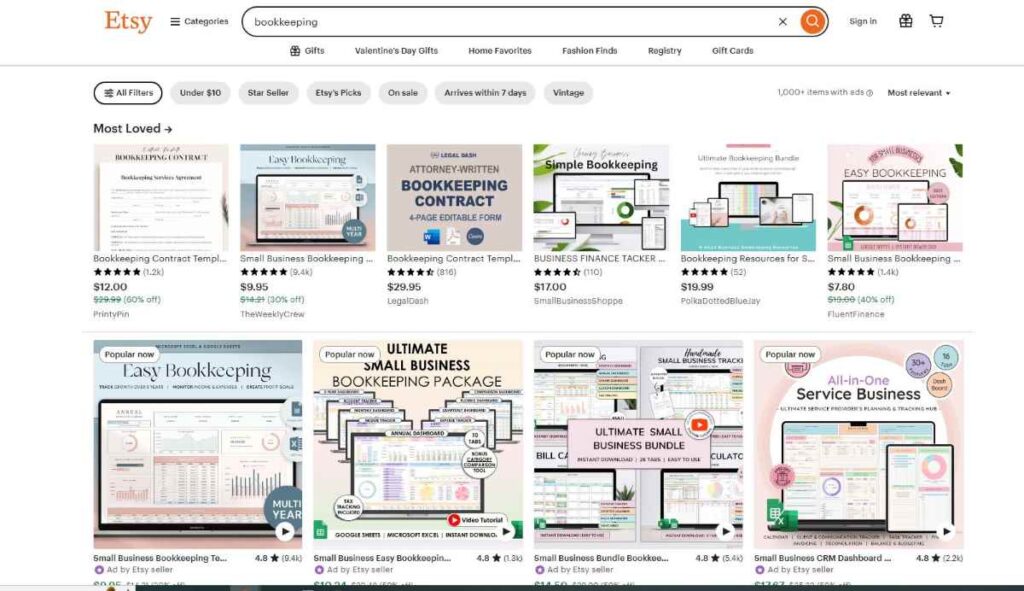

What Format is Best

The best format for books is the one that will get completed and used. If you’re a spreadsheet kind of person, by all means, compile your monthly figures on a spreadsheet. Etsy is a good source of bookkeeping spreadsheet templates. You might be a paper-and-pencil kind of person, and that’s fine too. Purchase a couple of ledgers or print these pages from Etsy to track income and expenses and start tracking those figures. Note that the two aforementioned bookkeeping methods are fine but can quickly become cumbersome if you have to track how much you paid each vendor for 1099 purposes, calculate sales tax by city, and/or keep payroll records.

The alternative to these methods is to purchase bookkeeping software. Most software has moved to online access and has a monthly license fee to use it. If you go the software route it is money well spent to have your accountant or a bookkeeper set up your books so that you get started off on the right foot.

Which Bookkeeping Software Should You Use?

I’ve found that the “best” bookkeeping program comes down to personal preference. A program that is one person’s godsend will be another person’s nemesis. Most of the programs offer free trials and don’t be afraid if you don’t like one to try another. If you’re going to be doing the books you had better be comfortable with the software. I also recommend asking your accountant what programs they work with. It makes life simple when you can add your accountant as a user to your online software and give them access to review your books.

Popular Bookkeeping Programs

Intuit Quickbooks

One of the dominant accounting programs with over 7 millions subscribers worldwide is Intuit Quickbooks. It’s been around for a long time and is tried and tested. It starts at a basic level with Quickbooks Simple Start for very basic bookkeeping features and has more elaborate levels such as Plus and Advanced which add more features like bill payment, time tracking, inventory, etc. if and/when your business grows to need them. Quickbooks is more expensive than the software recommendations that follow, and I do find that Intuit does nickel and dime you. At this time prices start at $17.50 a month. They also offer payroll services.

Zoho Books

Zoho Books with a mere 21000 subscribers is nowhere near as popular as Quickbooks but has a lot to offer including a “freemium package” for those with sales less than 50K per year which is a great choice if you’re just starting out. As your business grows, Zoho has paid versions that accommodate your business growth and has payroll modules for doing payroll. Zoho also offers CRM and Project management software that will integrate with Zoho Books. You won’t find as many accountants and bookkeepers using it so if it’s your choice know that it’ll be harder to get help using it.

Wave Accounting

I’ve had a few clients over the year who use Wave Accounting which isn’t surprising since it boasts over 500,000 subscribers. It too has a free version and the paid version is very affordable. It is not quite as intuitive as Quickbooks or Zoho, but some people like it, so it’s worth mentioning. Wave offers payroll services in some states.

Xero Accounting

Xero accounting boasts 4.2 subscribers worldwide and is another solid choice. Like the other software mentioned it has different levels to grow with your business and the base program starts at $20 per month and has levels with increased offerings as your business grows. Xero doesn’t offer its own payroll service but does integrate with Gusto

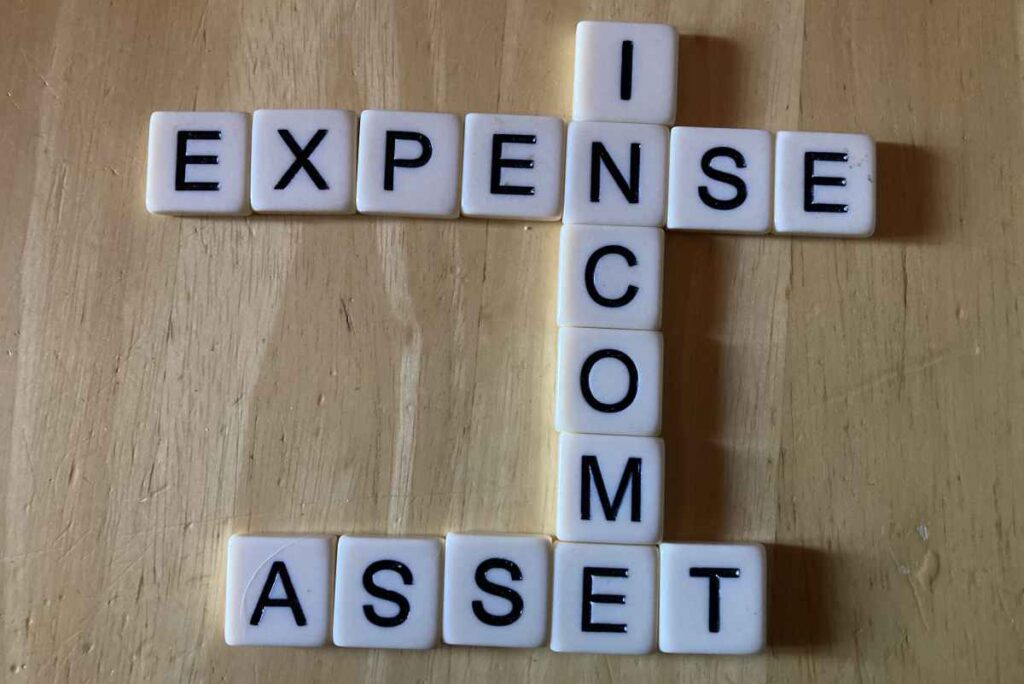

What Records Do I Need to Keep

At a minimum, you need to track the following for your small business:

- Income: Money your business is paid for sales of products, services, licenses etc.

- Expenses: Per the IRS expenses are the cost of operations that a company incurs to generate revenue ie money paid out for services, product, etc.

- Assets: Assets are anything of value that an individual, a business enterprise, or another entity owns. Different types of assets are treated differently for tax and accounting purposes. Examples of typical business assets are Cash, Accounts receivable, and Equipment.

- Liabilities: Liabilities are monies owed.

- Capital:

-Capital Contributions are the money an owner invests in the company and are not considered income.

-Capital withdrawals are the funds the owner takes out of the company and are not considered expenses.

- Track vehicle mileage (personal and business)

All of the above items can be tracked using a simple cash receipts and cash disbursements journal with the following columns:

- Date of the transaction

- Customer or Vendor name

- Amount of the Transactions

- And then a category for example advertising, rent, utility etc.

Total your transactions by month and then at the end of the year by year.

If you have employees and need to track payroll taxes and file payroll reports I highly recommend you use an online payroll company like

An essential task that a business owner needs to do each month is to reconcile the bank accounts. This is 100% the best way to find errors in bookkeeping.

At the end of January each year, US businesses must issue Forms 1099 to contractors to whom they have paid $600 or more for services. If you doing manual books or spreadsheets you will need to track payments to vendors individually to track this data.

Keep Your Small Business Books Separate from Personal Finances

It is essential to open a separate bank account for your business. You may think that with just a few transactions that this is overkill but it is essential to separate your personal finances from your business finances. The IRS frowns on co-mingling funds.

How to Learn Bookkeeping Basics

Many people learn how to keep the books for their small business by doing them. If you want to get a head start you can take a course at a community college or an online course. YouTube has a plethora of videos on how to keep books for your small business. Watch a few of the popular videos and you should be ready in no time at all to tackle keeping the books for your business.

5 Comments

Jarrod

Very well written and lots of great information! Thanks for sharing!

Carolyn

You’re welcome. I like people to get off on the right foot!

Nancy

Useful

Information

Nancy

Very useful information

Carolyn

I hope you can put it to good use.