Is Now a Good Time to Buy a Home?

Is Now a Good Time to Buy a Home or Not?

Table of Contents

It’s a very confusing time for homebuyers, the housing market appears to have peaked but interest rates continue to edge upwards and so do rents. Is now a good time to buy a home or should you hold out a while longer hoping for prices and/or interest rates to fall?

Buying Power Explained

One of the primary factors to consider in making this decision is “Buying Power”. What is buying power? Your buying power is comprised of the total amount of money you have available each month for a mortgage payment. This means the money you have available after non- housing-related fixed bills and expenses.

Non-housing Related Fixed Bills and Expenses

What bills and expenses are these? These are payments you are obligated to make that are not related to your housing and are non-discretionary. Examples are:

- Loan payments

- Credit card payments

- Phone bill

- Child support payments

- Health insurance

- Car insurance

Interest Rates and Home Buying Power

Interest rates are inversely related to home buying power. As interest rates rise, home buying power decreases. This is because more of your monthly mortgage payment will go towards interest costs.

Low-interest rates have spurred the real estate market in the last few years as buyers had more buying power.

Rules of Thumb

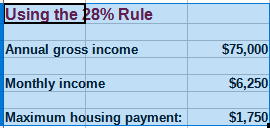

28% Housing Payment Rule

There are a couple of good rules of thumb to keep in mind when calculating home buying power. The first is that no more than 28% of your gross income (this is income before taxes) should go to housing costs. Included in housing costs are mortgage or rent payments, home (or renters) insurance, property taxes, and HOA fees.

36% Total Debt Rule

The second rule, the 36% rule, is that no more than 36% of your gross income should go to debt repayment. This includes your housing payments described above as well as student loans, credit card payments, auto payments, etc.

Denver Home Buyer Case Study

Suzy has an annual income of $75,000. She’d like to buy her first house and wants to know how much she can afford. She has $60,000 saved for a down payment. Her monthly fixed expenses include:

- $120 for car insurance

- $ 50 for phone

- $100 monthly payment for employer-provided health insurance

Total: $ 270 monthly obligations

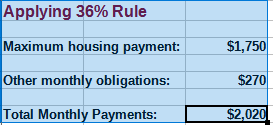

She’d like to get a 20-year mortgage as she knows she’ll pay much more interest over the life of the loan if she takes out a 30-year mortgage. She can currently get a 20-year mortgage with a rate of 5.25%.

With 60,000 saved for a down payment, Suzy is looking at homes priced at $300,000 or less as she wants to put 20% down on her house purchase to avoid having to pay Mortgage insurance premiums.

Using the 28% Housing Rule Suzy Calculates the following:

Applying the 36% rule Suzy’s crunches a few more numbers:

Plugging these figures into a home affordability calculator yields these results: Suzy can afford a monthly housing payment of $1750 which with her down payment would purchase a $286,000 house.

Unfortunately, Suzy lives in Denver where housing prices have skyrocketed in the last couple of years, increasing 13.3% in the last year. To buy an older 2 bedroom detached home not even $1000 sq ft will cost a minimum of $350,000. Meanwhile, average rents in Denver are $1,995.

At the moment it doesn’t make sense for Suzy to purchase a home in Denver. She can rent a far nicer home for less than what she’d pay to purchase one. She can continue to sock away down payment money and wait for rates and prices to decrease.

My Realtor tells me my Home Buying Power is Decreasing and that I need to Buy Now, is This True?

This sounds like a simple enough question to answer, but in reality, it is complex. The housing market has undergone a rally in recent years like no other in history. Low-interest rates and increased demand have fueled the rally. You, Suzy, and many others are worried about being priced right out of the market.

There is a little good news for potential homebuyers. According to leading economists, the housing market has peaked. Mortgage applications and pending home sales are down and according to Redfin 1 in 5 sellers are dropping their prices.

Why the shift? It’s mostly attributable to interest rate hikes but the following are also contributing factors:

- Existing homeowners who have locked in 30-year rates at 3% or less are less likely to sell their homes to upgrade, due to increased rates.

- An unpredictable market leads many homebuyers and sellers to wait to see the direction the market is heading

- Despite falling demand home prices have continued to rise with the US median home price crossing $400,000 for the first time.

- Rents are soaring, up 26.6% since the start of the pandemic, but increases have slowed.

Remember your realtor doesn’t get paid if you don’t buy a house so it’s in their best interest for you to buy now rather than wait to see the direction market goes.

Why have Interest Rates Increased so Much, Are they Likely to Come Down?

Why have rates increased? The Federal Reserve raises interest rates as a means to slow inflation. What is the logic behind this? As interest rates increase spending will slow, and lower demand results in falling prices.

Unfortunately in the short term it does not look like interest rates will be coming down, in fact, they may continue to rise. Federal interest rate hikes are anticipated into 2023. It is anticipated that rates might fall back in 2024.

Current mortgage rates are at multi-year highs; we haven’t seen rates this high since 2008.

Does it Make Sense For Anyone to Buy a Home in this Market?

When making a home-buying decision one must always consider the factors pertinent to one’s own situation and discard irrelevant facts.

Considerations should include:

- Local housing economy-if your local economy isn’t overpriced but rentals are high, it might be advantageous to purchase a home now;

- Financing options-if you can secure affordable financing perhaps a seller-financed option it may sway the options toward purchasing;

- Length of time you plan to stay in the house: If your timeframe before another likely move is only a few years I wouldn’t recommend buying now. If the real estate market declines you might actually lose on your home investment if you need to sell so soon. You also have to consider the closing costs that won’t be recovered.

- Family dynamics: Growing or shrinking? If you’re planning on having children that one-bedroom condo that fits you so well right now might become very cramped. Or likewise, if you’ll soon be an empty nester you might want to downsize shortly, do you really want to buy and sell in such a short time-frame?

- Your personal financial situation: If you have a steady job now but are considering a switch to a job that might now be as steady ie commission based, or self-employment vs salary, lenders may be more likely to lend to you now than in the future.

- Credit Score: Is your credit store as good as you can get it? Can you work on improving it so that should the right buying opportunity present itself, that you’ll be able to avail yourself to the best rates out there?

Options to Get a Foot in the Real Estate Market

If your local housing market prices are inflated and unaffordable, there are other options to get a foot in the real estate market.

Depending on your circumstances you might consider purchasing a rental property in another area. Though be aware that rental properties usually carry higher mortgage rates than those of your principal residence. And of course, if you use your savings for a down payment on an alternative real estate investment, you won’t have it readily available should the right house come on the market at the right price. Despite these caveats, this can be a strategy to take advantage of real estate opportunities and diversify your investment portfolio.

Another option is to invest in Non Publicly Traded REITs while waiting for the real estate market to stabilize. REITS are “Real Estate Investment Trusts”. I’ve invested in a couple of Non-Publicly Traded REIT’s in the last few years and their returns have been consistently in the 8%-10% range.

I’ve Found a Perfect Affordable Home, Should I Not Buy it Now?

The time for you to purchase your home is when it is right for you. If you have established that you don’t plan to move shortly, you have a stable income and are unlikely to change jobs in the near future and that home ownership is affordable and more beneficial than renting, go ahead and buy that perfect home! Housing prices may decline but it doesn’t mean that if you have the opportunity to purchase a house that’s perfect for you that you should pass on it.

Whether it’s a good time to buy a home or not, is a personal decision. Don’t be pressured by others, the decision is yours.

10 Comments

Sophia

Great article, and really important issue brought up! We need to plan well ahead and carefully – especially if being responsible for a whole family 🙂

In some countries buying a house is still considered as a “must”, and the “best investment”, but with the changing global economy, one should take into account all possible aspects!

christine

this is super helpful because we’re trying to buy right now!!

Carolyn

It’s such a tough market right now but whatever you do don’t rush!

Tamara - The Thrifty Apartment

This is such a great article that is very timely. Very insightful and helpful to anyone that is considering buying a home.

Carolyn

The market seems to have already taken the turn for the worse since posting this.

KEVIN FOODIE

Very informative post. I enjoyed reading the case study; it makes for better understanding. Seems like the housing maket is a sellers market at this time. The interest rates are extremely high. But as you said, to buy or not to buy is a personal decision.

Carolyn

I believe the tides are turning in most areas…

Carolyn

I’m glad you enjoyed the post. I think the market is rapidly changing into a buyer’s market.

Natalie

Very helpful information! Thank you 😊 I am saving this to refer back to, thanks again!

Carolyn

You’re very welcome!